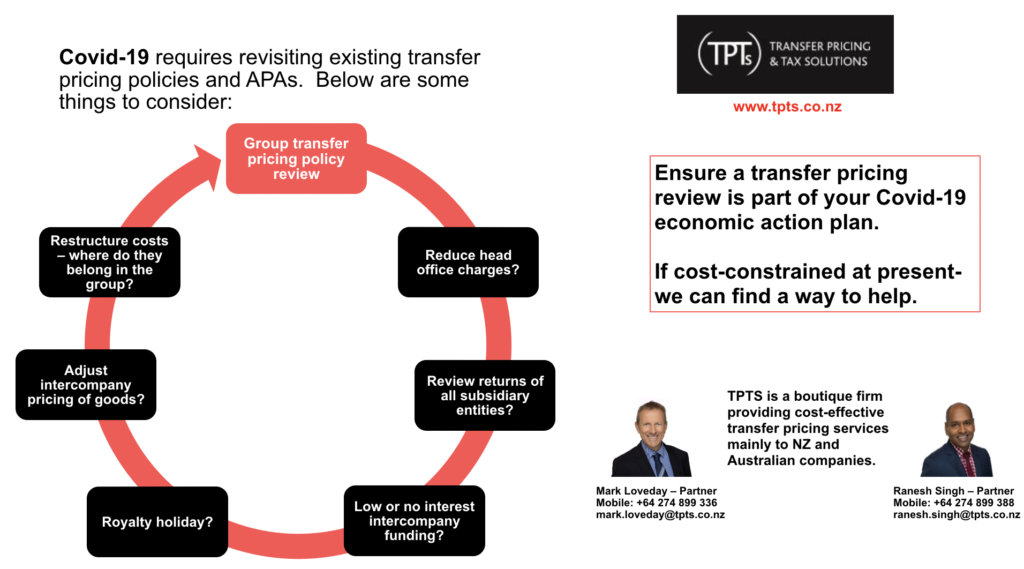

Since writing out our last insight (an update on BEPS 2.0) the world finds itself faced with significant change and substantial economic challenges. Whilst businesses are working on Covid-19 economic action plans, it is important to ensure that a review of the group’s existing transfer pricing is included. Some of the issues to consider include; reducing head office charges, reviewing returns of all subsidiary entities, intercompany funding, royalty holidays, intercompany pricing of goods, and allocation of restructure costs within the group. And of course transfer pricing is but one of many things needing attention as part of your economic action plan. However, it is our specialty, and we can find a way to help you even if cost-constrained presently.

- Written by: TPTS

- Posted on: March 31, 2020

- Tags: Transfer pricing covid-19 Australia, Transfer pricing Covid-19 New Zealand, Transfer pricing covid-19 NZ, Transfer pricing NZ

2 comments

Transfer Pricing Documentation - fit for purpose? -

April 2, 2020 at 1:29 pm[…] See our recent insight on Transfer Pricing & Covid-19. […]

Tax treaty implications for various Covid-19 issues - Transfer Pricing & Tax Solutions

April 9, 2020 at 2:24 pm[…] See our previous insight Transfer Pricing & Covid–19: https://www.tpts.co.nz/blog/2020/03/31/transfer-pricing-covid-19/ […]