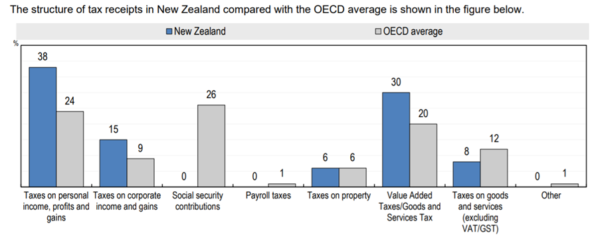

According to recent data released by OECD (includes up to 2018 provisional data), New Zealand:

- Ranks below the OECD average for total taxes levied as a % of GDP, but is higher than Australia, Japan and USA. But note that New Zealand is:

- Fourth highest in OECD for personal tax as a % of total labour costs (two earner family with 2 children). But, well below OECD average for personal taxes if social security contributions are counted

- Has a corporate tax rate (28%) above OECD average (23.7%)

- Is one of the highest countries in terms of company tax levied as a % of total tax revenue – Australia is higher than New Zealand

- Is one of the highest countries in terms of GST (and other consumption taxes) levied as a % of total tax revenue (yet has a relatively low GST rate)

- Written by: TPTS

- Posted on: July 21, 2020

- Tags: NewZealandtaxrates, OECD transfer pricing, TPTS, TPTSNZ, worldtaxrates