BEPS 2.0 will not be a windfall for New Zealand. The OECD estimate that their latest international tax proposals will reap US$100b additional tax in aggregate for all countries. These initiatives arise from a reallocation of some group profits away from low tax jurisdictions into higher taxing countries, like New Zealand.

OECD estimate that high-income countries, like NZ, would benefit from an increase in tax revenues of over 4%, which suggests $600m more tax revenue for NZ.[1] We believe the reality is that any benefit to NZ is likely a fraction of that amount.

We previously outlined an overview of how OECD’s ‘Pillar 1’ and ‘Pillar 2’ initiatives (also together referred to as BEPS 2.0) would work (see our 11/2019 article and our 03/2020 article).

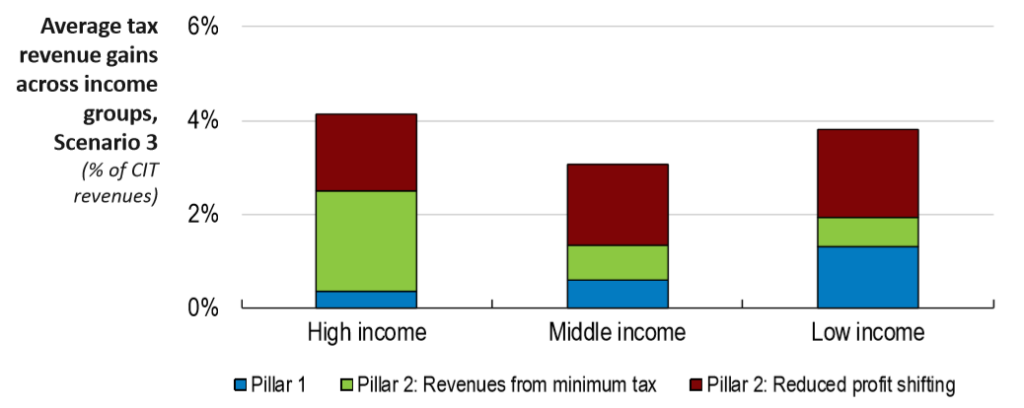

A summary of OECD’s modelling of estimate tax revenue gains from both Pillar 1 and Pillar 2 is shown in the graph below:

OECD’s modelling suggests that high income countries might expect a company tax revenue increase of 0.4% from Pillar 1. For NZ, that would represent around $60m more tax revenue increase. Certainly, NZ coffers would benefit to the extent in-scope foreign companies are forced to share some of their offshore residual profits with market countries, like NZ. Few NZ headquartered companies meet the €750m de minimis turnover threshold and are in-scope companies. Therefore, NZ is likely to lose little tax revenue from its own companies.

OECD has modelled that most of the tax revenue gain (around 2.1% increase) will come from Pillar 2 initiatives. Also, if multinationals take action to shift activities out of low tax countries, a further 1.7% increase has been modelled. For NZ, that represents a further $570m of tax revenue if Pillar 2 rules are introduced.[1]

We do not consider NZ is likely to see any significant lift in tax revenues from Pillar 2 as modelled by OECD, for the following reasons:

- In our experience, most NZ companies do not operate businesses or have subsidiaries conducting substantive business in low tax countries (at least countries taxing with a tax rate less than 12.5%). Most NZ companies with offshore investment tend to have operations in higher taxing countries, such as Australia, United States, China, Japan and various European countries.

- The CFC rules, transfer pricing rules and tax avoidance rules tend to deter NZ companies from locating intangible assets in low tax jurisdictions.

- The OECD modelling is likely to reflect the larger corporate groups in US and Europe where substantive activities may well sit in low taxing countries.

- Some NZ companies would be a payer in some transactions with countries that do not tax foreign-sourced income (e.g. Hong Kong and Singapore), but our experience is that these are not significant.

- There is likely to be some de minimis thresholds (possibly a €750m revenue threshold) that would carve out most NZ companies.

TPTS will keep you informed of the details of BEPS 2.0 as the work progresses.

If you found this insight, ‘BEPS 2.0 Will not be a windfall for New Zealand’, useful, please visit our other insights.

[1] The modelling does rely on many assumptions at present given that the architecture of GloBE is still a work in progress.

[1] The total company tax revenue is around $15b pa

2 comments

Transfer Pricing & Covid-19 - Transfer Pricing & Tax Solutions

April 1, 2020 at 6:47 pm[…] Click here to see our last post about BEPS 2.0 […]

Did Google allocate excessive profits to its NZ operations? | Transfer Pricing & Tax Solutions

June 15, 2020 at 7:36 pm[…] allocating a greater portion of its offshore profits to NZ. As TPTS commented in our previous article, an initial estimate of OECD’s Pillar 1 proposals suggests only $60m additional tax revenue […]