We previously outlined an overview of how OECD’s ‘Pillar 1’ and ‘Pillar 2’ initiatives (together referred to as BEPS 2.0) would work (see Nov 2019 article). Subsequently, OECD/G20 has provided an update of the BEPS 2.0 project (OECD Statement) and OECD recently made a public webcast. This article provides an update on the framework being suggested and how it might apply to NZ businesses.

To recap, Pillar 1 seeks to define a new international taxing right for profits from the digital economy and get worldwide consensus rather than have countries unilaterally implement a digital services tax. It will apply to a range of businesses involving ‘automated digital services’, such as social media platforms, online search engines, and online retailers. However, it will also apply to more traditional “consumer-facing businesses” where goods are sold directly to individual consumers or indirectly through third-party resellers or intermediaries that perform routine tasks such as minor assembly and packaging.

The OECD state that consumer-facing businesses would include products such as:

- Personal computers

- Phones

- Branded foods and beverages

- Cars

- Clothes, toiletries, cosmetics, luxury goods

The above list will include many foreign companies that sell their branded goods in NZ directly or through a reseller. It appears this includes companies that market their branded goods to consumers in New Zealand through third-party retailers or resellers. An in-scope company will need to have sufficient nexus with the market through a physical presence or targeted advertising. Specifically excluded will be sellers of raw materials and commodities, extractive industries, financial services, and international transport. We would expect that Fonterra’s commodity product businesses would likely be excluded, but its branded products sold in overseas markets may well be in-scope.

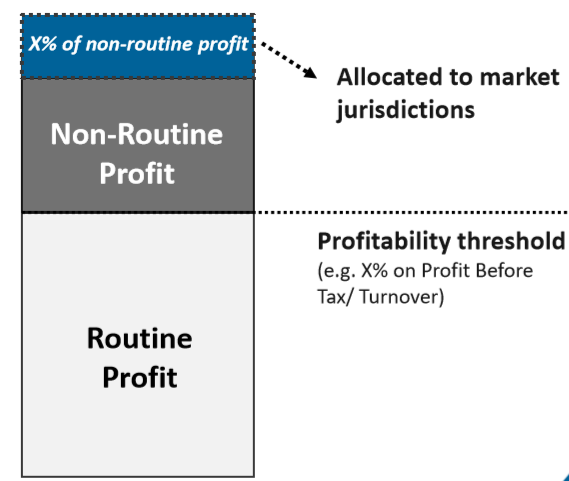

Pillar 1 proposes the allocation of three possible amounts to a market jurisdiction in dividing up the group’s profits. ‘Amount A’ has attracted the most interest as it seeks to allocate a proportion of the global group’s residual profits from ‘marketing intangibles’ to the market countries where sales occur. This is a new taxing right beyond the existing transfer pricing rules. Countries like NZ would stand to share in some of the residual profits which are currently captured overseas where most of the marketing intangibles of in-scope companies are located.

‘Amount B’ is a return for baseline marketing and distribution activities. Distributors of goods in NZ would typically already receive Amount B, but the proposal is that the percentage return will remain consistent with the arm’s length principle but would be a standardised fixed return.

It needs to be remembered that many in-scope foreign companies have already been investigated by Inland Revenue and some may, in fact, be returning more profit than would be determined by Amount B. Potentially, the activities in NZ go beyond the baseline distribution and therefore some dispute resolution mechanism is needed to determine whether another amount should be allocated to the market country (‘Amount C’).

The diagram below shows the routine profits belonging to the market jurisdiction (Amount B) and a percentage of the non-routine profits (Amount A) also being allocated to the market countries.

Note that the proposal is that Amount A would typically only be required for corporate groups with revenue over €750m. This would carve out most NZ headquartered companies[1] but would include many foreign companies marketing digital services in NZ or selling in-scope products to consumers in NZ. Other de minimis thresholds are likely to further restrict the application for New Zealand, such as requiring minimum in-scope revenues for a country and minimum level of residual profits.Pillar 2 calls for the development of a co-ordinated set of rules to address ongoing risks from multinationals shifting profits to jurisdictions where they are subject to no or very low taxation. For example, Groups locating intangibles in tax havens and developing regional marketing intangibles in countries such as Ireland and Singapore. The aim is to create a disincentive for Groups to locate their activities in low tax countries and a disincentive for countries to compete in a ’race to the bottom’ on the corporate tax rate. Pillar 2 proposes a new regime that is labeled “global anti-base erosion” (or ‘GloBE’).[1] In our previous article, we outlined the proposed four ‘rules’ comprising GloBE.

Under the income inclusion rule, Pillar 2 would work to complement the controlled foreign company (CFC) regime for NZ companies. Basically, where a foreign subsidiary had an effective tax rate below 12.5% (the rate modelled by OECD), the parent would be required to top up that tax to the minimum amount.[2] Setting the bar at 12.5% would prima facie exclude jurisdictions such as Ireland, Singapore and Hong Kong (although the latter two do not apply a worldwide tax system).

If, for example, an NZ Group has a subsidiary in UAE that pays zero tax on its profits, Inland Revenue may have a right to require the minimum 12.5% tax be paid in NZ on those profits. NZ’s CFC rules would presently not seek to tax the UAE profits where they derive from active business.

Potentially NZ companies may have tax under GloBE where they have established business in a jurisdiction that grants a tax incentive, such as a tax holiday. Similarly, an offshore parent may have to top-up the tax of an NZ subsidiary that enjoys an untaxed capital gain in NZ.

The Pillar 1 and 2 projects continue to consider specific issues with an expected agreement on key policy features in early July and an aim to have a final agreement of G20 by the end of 2020. TPTS will keep you informed of the progress of this fundamental reform.

[1] OECD: Public consultative document; Global Anti-base Erosion Proposal (“GloBE”)- Pillar Two

[2] Based on the income inclusion method modelled by OECD

[1] There are only around 20 NZ headquartered groups that meet that threshold and very few of those would have in-scope activities.