Welcome to our Tax Insights for November where we cover a range of recent international tax developments (concentrating on Inland Revenue’s Multinational Compliance Focus) that may be relevant to your business. We trust you will find them informative. Please feel free to contact our Partners Mark Loveday or Ranesh Singh on any of the issues that may concern you.

Inland Revenue’s Multinational Compliance Focus

This month Inland Revenue has launched its 2019 Compliance Focus document. The document will be published on Inland Revenue’s transformed website shortly, however, in the interim has circulated some paper copies of the document and undertaken some forums in Wellington and Auckland last week.

While the key focus areas remain similar to previous documents, it is very apparent that Inland Revenue has been using the intelligence gained from the volume of information received on foreign multinational groups through implementation of country-by-country (CbC) reporting (BEPS Action 13). Specifically, the CbC report enables Inland Revenue to refine their thinking on target entities.

Interestingly 67% of the foreign multinationals operating in New Zealand with reported turnover in excess of $30m, file CbC reports that Inland Revenue has access to- 1402 CbC reports were received by in the year ended 31 December 2018.

It is very clear that Inland Revenue will focus its activities on taxpayers that have:

- Consecutive years of tax losses

- Low or negative profits1

- Royalties as a significant proportion of EBITE

- High interest payments as a percentage of EBITDA

- $20m+ deductible payments to low/no tax jurisdictions

- Thin capitalisation percentage greater than 40%

- Cash pooling arrangements

- Guarantees and cross guarantees

- Derivatives

With new analytical tools, increased data and additional tools coming through the Business Transformation programme, it is clear that Inland Revenue will be looking to revamp its existing practice and focus on taxpayers’ positions on a timelier and more informed basis.

While little mention was made of the impact of the changes introduced to the New Zealand international tax regime through the adoption of various BEPS Actions, Inland Revenue is clearly documentation aligned to the new transfer pricing rules. This would involve multinationals undertaking:

- greater focus on demonstrating and evidencing the functions, asset and risks of the business in New Zealand;

- accurately delineating the transactions and the substance of the business; and

- contemporaneous benchmarking.

Inland Revenue is also focused on taxpayers reviewing their cross-border related party financing arrangements and supporting that their tax positions are aligned to the relevant rules. The restricted transfer pricing rule on related party interest is likely to result in group double tax and it is important multinationals give due attention to their related party borrowing arrangements.

Overall the Compliance Focus document is very informative and mentions Inland Revenue’s safe harbour measures to help reduce transfer pricing compliance costs. However, clearly Inland Revenue will proactively defend its tax base from erosion and taxpayers are expected to ensure they have done enough to discharge their onus of proof.

Significant international tax changes are imminent

This month we focus on further proposals by OECD to substantially change the long-standing international tax rules. Specifically, we discuss below OECD’s recently released proposals.

Proposals for two significant changes (called the “Unified Approach” and “GloBE Proposal”) were released for public consultation in October and November respectively. Both seek to address the concerns of multinationals operating in the digitised economy that are not considered to be paying their fair share of tax in the countries where most consumers/users are based. But the scope is far wider, with probable application to any large consumer facing business that markets products/services to consumers (including users).

The ‘Unified Approach’ seeks to widen the taxing rights by creating a ‘virtual permanent establishment’ (VPE) concept and looks to allocate a share of group profits (or losses) earned from the marketing intangibles to those countries where a VPE exists (i.e. in which the consumers are based). Marketing intangibles are typically brands, data, customer and user base. Profits relating to routine functions (e.g. distribution, services and manufacturing without unique intangible value) and to ‘trade intangibles’ (e.g. algorithms, patents, software) would not be subject to this potential re-allocation. The reallocation is aimed at residual group profits relating to marketing intangibles.

A baseline return will be set for companies that undertake sales and marketing functions in the market country, with the potential for this presumption to be challenged by tax authority or taxpayer if that functional characterisation is not considered appropriate.

A Group revenue threshold will exclude smaller multinationals. The initial suggestion is this be set at €750m, which would exclude most New Zealand headquartered companies. Additionally, de mininis revenue thresholds are likely to be set to require allocation to certain market countries. Some businesses have already been signalled as being excluded (commodities, extractive industries and financial services).

Many foreign owned multinationals may be required to allocate a portion of their offshore profits (from marketing intangibles) to New Zealand. However, we do not yet know how the de minimis revenue level will be set for the New Zealand market and the level of baseline returns that New Zealand distributors could expect to earn. Until there is more detail, it is hard to know whether New Zealand Inc. is likely to be a net beneficiary from these changes- although it seems likely to be the case.

The OECD is looking to gain consensus from the 134 countries involved in this project by the first half of 2020. Public comments on the consultative document are to be considered shortly.

GloBE proposal public consultation document

Released on 9th November, the Pillar Two document compliments the Unified Approach under Pillar One. It proposes a radical change to the international tax architecture by ensuring the profits of internationally operating businesses are subject to a minimum rate of tax.

The aim of the proposal is to create a disincentive for multinationals to locate intangible assets in low or no tax jurisdictions and to neutralise any competition between countries to reduce their corporate tax rates.

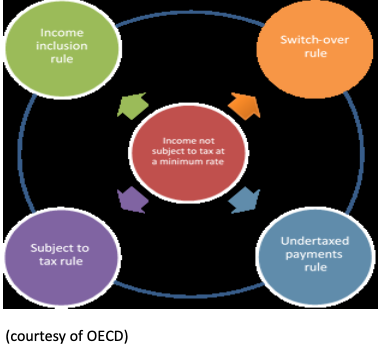

The proposal involves four component parts which is encapsulated in the following diagram:

a) an income inclusion rule – designed to tax income of a foreign branch or a controlled entity if that income was subject to tax at an effective rate that is below a minimum rate;

b) an undertaxed payments rule – deny deduction or impose source-based taxation (including withholding tax) for a payment to a related party if that payment was not subject to tax at or above a minimum rate;

c) a switch-over rule to be introduced into tax treaties – would permit a residence jurisdiction to switch from an exemption to a credit method profits attributable to a permanent establishment (PE) or derived from immovable property (which is not part of a PE) are subject to an effective rate below the minimum rate; and

d) a subject to tax rule – would complement the undertaxed payment rule by subjecting a payment to withholding or other taxes at source and adjusting eligibility for treaty benefits on certain items of income where the payment is not subject to tax at a minimum rate.

Presently there is little detail in the proposal and OECD is requesting comments on numerous questions to help further develop the proposal. The rules would be implemented by way of changes to domestic law and tax treaties and would incorporate a co-ordination or ordering rule to avoid the risk of double taxation that might otherwise arise where more than one jurisdiction sought to apply these rules to the same structure or arrangement.

It is unlikely to impact many New Zealand headquartered businesses given more traditional higher taxpaying markets that New Zealand companies typically operate in. Additionally, features in the New Zealand tax regime (attribution of passive income under CFC rules; transfer pricing rules and general anti-avoidance) make it more difficult for New Zealand companies to restructure to relocate valuable intangible assets in low tax countries. Nevertheless, New Zealand companies operating in countries that have low corporate tax rates and/or highly incentivised tax schemes should be reviewing their tax frameworks and operating models to determine if they are impacted.

Footnote:

1 IRD has developed minimum levels of Earnings Before Interest Tax and Exceptional items as a percentage of sales (EBITE margin) for distributors, retailers, and manufacturers.

The relevant IRD document can be found here: https://www.classic.ird.govt.nz/resources/4/3/43264550-b294-4598-8545-f1f05322fe45/compliance-focus-2019.pdf

Our other insights can be found here: https://www.tpts.co.nz/blog/

- Written by: TPTS

- Posted on: November 19, 2019

- Tags: IRD, IRDNZ, Multinational-Compliance, TPTS, TPTSNZ