In June 2019 the Government stated its preferred approach to wait for OECD to develop its multinational solution to change the taxing rules for digitised companies, “but it will seriously consider a digital services tax (“DST”) if the OECD cannot make sufficient progress this year.” It was estimated that a DST could bring in a further $80m pa into the New Zealand coffers.

As the world’s major digital companies are headquartered in the United States, US authorities naturally oppose any DST, which is effectively an additional turnover tax, and do not seem keen to have OECD’s proposed Pillar 1 rules mandated on their companies. Potential retaliatory trade action from US creates some doubt that New Zealand will ever accrue any significant income taxes from the world’s digital behemoths – the US is New Zealand’s third largest export market.

The OECD has made progress to amend the international tax rules but still appears some way off getting consensus on its Pillar 1 proposal to change the way in which digitised companies should allocate profits between countries.

Many countries have either implemented or proposed some form of specific DST. Those with a DST already implemented include Austria, France, Hungary, Indonesia, India, Italy, Turkey, and the United Kingdom. Some other European countries have proposed a DST.

The US Treasury Secretary position is that “the United States opposes digital services taxes because of their “discriminatory” implications for U.S. businesses” and prefers a global consensus approach. But in terms of OECD’s proposed Pillar 1, has suggested that it be a safe-harbour regime (i.e. companies can elect into the regime). That seems unacceptable to the major European countries backing the OECD Pillar 1 approach.

The US has also challenged the French DST under section 301 of the Trade Act (1974). Under that statute, if the Trade Representative determines that an act, policy or practice is unreasonable or discriminatory and burdens or restricts US commerce, it may impose duties, fees or other import restrictions on the goods or services of the other country. In a December 2019 report, the US Trade Representative concluded that the French DST discriminated against US digital companies. They stated that the French Government even referred to the DST as a ‘GAFA Tax’ (meaning Google, Apple, Facebook and Amazon). The US proposed punitive tariffs on $2.4b of imports from France.

To appease US trade officials, France has suspended its DST collections till the end of 2020 and pending a successful outcome by OECD on Pillar 1. However, recent updates from OECD suggest that consensus in 2020 is proving more difficult than was expected.

More recently, the US announced that it will similarly investigate the DST of other countries, including EU, India, Italy and UK. Such actions should deter New Zealand from taking any future unilateral action regarding imposing a DST.

Given New Zealand’s large fiscal hole, the Government would certainly welcome OECD reaching a consensus on Pillar 1 to levy more tax from the large digital companies that earn revenues from the New Zealand market. There is no certainty that will happen and the US is certainly not giving the rest of the world a ‘free hit’ to change the tax rules. It also seems prepared to fight countries imposing a DST.

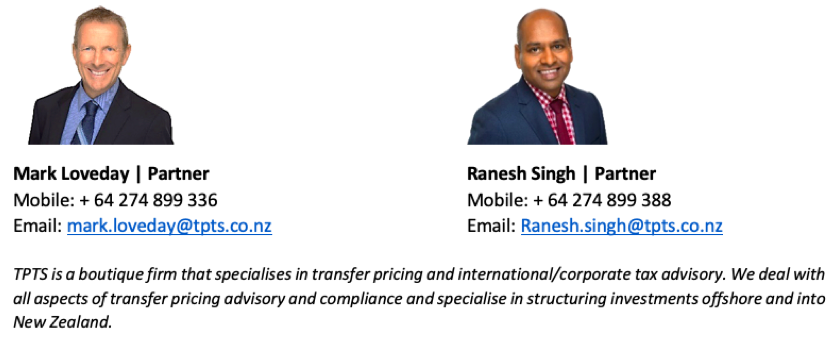

- Written by: TPTS

- Posted on: June 9, 2020

- Tags: International tax covid-19, OECD covid-19 tax treaty, TPTS, TPTSNZ, transfer pricing covid-19, Transfer pricing covid-19 NZ, Transfer pricing NZ